Share Market Insights For Smarter Investment Choices

The Share Market has long been a place where individuals and institutions come together to buy and sell securities. For new investors, it can seem complex at first, but gaining the right knowledge makes it more approachable. Whether you are planning to build wealth over time or looking to explore short-term opportunities, understanding the Share Market is a vital step.

Before anyone starts trading or investing, it is important to create a Demat Account, which acts as a digital vault for your securities. Without this, participating in the market is not possible. By learning about market dynamics and having the right tools, investors can make decisions that are better aligned with their financial goals.

Understanding the Share Market

The Share Market operates as a platform where shares of listed companies are bought and sold. Prices move based on supply, demand, and investor perception of a company’s performance. These fluctuations present opportunities for both profit and loss, making knowledge the most important asset for participants.

For beginners, it is advisable to start with clear goals. Do you want steady returns over the long term, or are you aiming for short-term gains? Clarity in objectives helps determine the right approach. Once the basics are clear, the next step is to Create a Demat Account and ensure you have access to the tools required to start trading safely.

Key Components of the Share Market

Primary Market

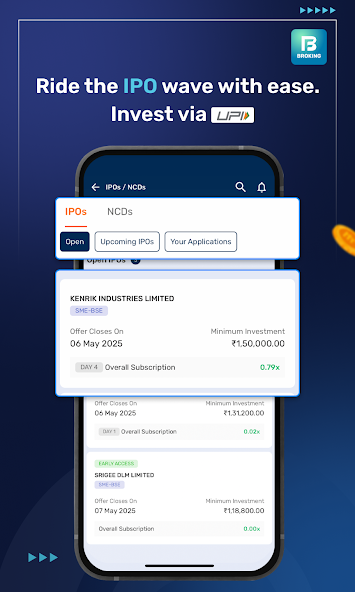

The primary market is where new securities are issued for the first time. Companies raise funds by offering their shares to the public, and investors get a chance to buy them directly. This stage allows businesses to grow while giving investors access to new opportunities.

Secondary Market

Once shares are issued, they move to the secondary market. This is the more familiar space where day-to-day trading happens. Here, investors buy and sell among themselves, and prices fluctuate constantly. Having a Demat Account is essential for participating in these transactions.

Why the Share Market Matters

The Share Market plays a major role in wealth creation. By owning shares, investors indirectly own a part of the company. If the company grows, its shareholders benefit through price appreciation and possible dividends. On a larger scale, the market supports economic growth by helping businesses raise capital and expand operations.

Additionally, the Share Market encourages discipline in personal finance. Regular investment over a period of time helps individuals prepare for future needs such as retirement or major expenses. With the support of a well-maintained Demat Account, this process becomes seamless and secure.

Steps Before Entering the Share Market

Define Your Investment Plan

An investor should begin with an outline of financial goals. A long-term plan may focus on building assets steadily, while a short-term plan may look for price movements to generate faster returns.

Learn Market Fundamentals

Basic understanding of how the Share Market functions can save investors from unnecessary risks. Learn about order types, price movements, and the impact of external events such as policy changes or economic announcements.

Open and Manage a Demat Account

To store and manage your holdings, you need to create a Demat Account with a registered service provider. This account keeps shares in electronic form, making trading safe and hassle-free. Keeping it active and updated is equally important.

Common Strategies in the Share Market

Long-Term Holding

Many investors prefer to buy shares of companies they believe will grow over the years. This strategy reduces the impact of daily price fluctuations and focuses on overall wealth creation.

Short-Term Trading

For those seeking quicker returns, short-term trading methods like intraday or swing trading may be suitable. This requires close observation of price movements and market signals.

Diversification

One of the most important approaches in the Share Market is diversification. By investing in different sectors and instruments, investors reduce risk and increase the chances of steady returns.

Risks in the Share Market

Every investment carries some degree of risk, and the Share Market is no exception. Prices can be influenced by global trends, local policies, or even sudden events. Being aware of risks is necessary to avoid major losses.

Maintaining discipline, setting stop-loss limits, and not investing money that you cannot afford to lose are important practices. A well-structured Demat Account ensures that your holdings are secure, but the decision-making process still lies in your hands.

Role of Research and Analysis

A successful investor spends time analyzing the market. Reading company reports, studying economic indicators, and following market news help in forming better strategies. Some investors rely on technical charts, while others prefer fundamental research. Both methods have their place, and combining them can provide a balanced view.

The Share Market rewards patience and knowledge more than guesswork. Taking time to learn before making big moves can result in better outcomes.

Preparing for the Future

With technology making access easier, participation in the Share Market is no longer limited to a small group of people. Anyone willing to learn and take measured risks can benefit. Creating financial habits like systematic investing, portfolio reviews, and timely decisions help in building long-term security.

A properly managed Demat Account becomes the center of this journey. It keeps investments organized and gives investors confidence to explore different opportunities without fear of losing track.

Conclusion

The Share Market offers opportunities for individuals to grow wealth, support businesses, and achieve personal financial goals. From understanding how the market works to developing strategies, every step requires careful thought. The first and most essential step is to Create a Demat Account, which opens the door to this investment space.

While risks exist, they can be managed with discipline, diversification, and consistent learning. By approaching the Share Market with patience and a clear plan, investors can make choices that align with their future goals. Ultimately, informed decisions backed by proper preparation lead to smarter investment outcomes.